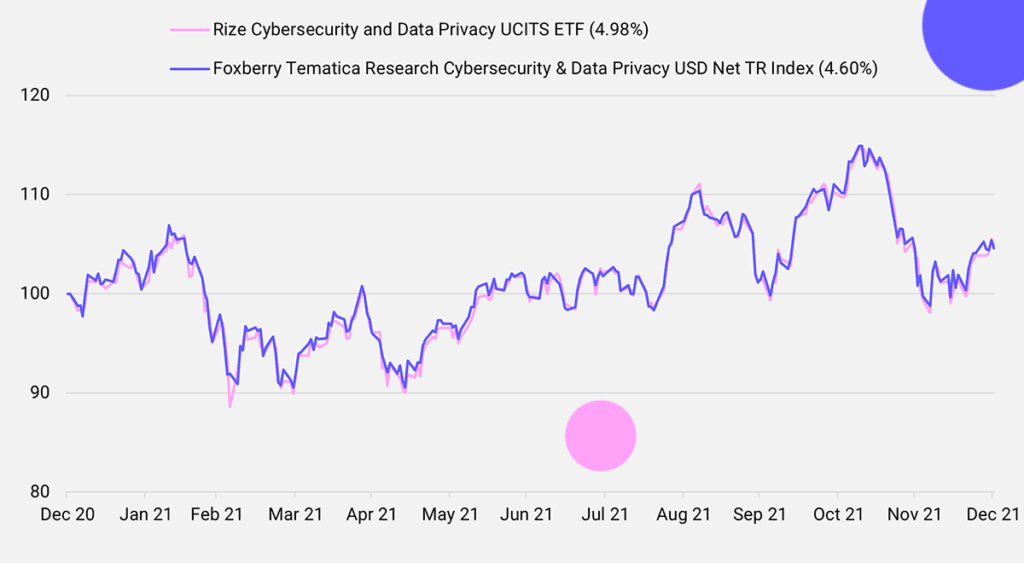

It was a challenging year for cybersecurity investors due to various macro developments which affected many names in the Rize Cybersecurity and Data Privacy UCITS ETF. The fund sold off over the first quarter of 2021 before regaining ground and then went on to perform well up until Q4 when there was a sharp drawdown in performance. Overall, the fund posted positive returns on the year.

Performance

| Q4 (30 Sep ’21 to 31 Dec ’21) | 1 Year (31 Dec ’20 to 31 Dec ’21) | Annualised Since Inception (17 Feb ’20 to 31 Dec ’21) | |

| ETF Return | 3.40% | 4.98% | 24.43% |

| Index Return | 3.12% | 4.60% | 24.99% |

| Tracking Difference | 0.28% | 0.38% | -0.56% |

Source: Bloomberg, as of 31 Dec 2021. ETF performance is the Rize Cybersecurity and Data Privacy UCITS ETF which tracks the Foxberry Tematica Research Cybersecurity & Data Privacy Index NTR.

The ETF closely tracked its index with a tracking difference of 0.38% in 2021. This is in line with expectations. There are a number of factors contributing to tracking difference including the TER of 0.45%, as well as trading and rebalancing costs, performance during the period and also historical tracking during the period. Some of these can have positive as well as negative impacts on tracking difference.

Source: Bloomberg, as of 31 Dec 2021. The performance shown relates to the one year period between 31 Dec 2020 and 31 Dec 2021 for the Rize Cybersecurity and Data Privacy UCITS ETF which tracks the Foxberry Tematica Research Cybersecurity & Data Privacy Index NTR.

Analysis

In November there was broad risk off sentiment across developed markets despite strong economic data. This was driven by the arrival of the Omicron variant and rising hospitalizations with investors concerned about the efficacy of existing vaccines. This was also against a backdrop of high inflation and the potential tightening of monetary policy (which would make future cash flows less attractive for many growth names in the IT sector) although the virus developments caused further confusion as to whether this normalization process would be delayed further still. These developments saw many of the names in our index selloff from previously high valuations and therefore negatively impacted the returns. For example, Darktrace and Crowdstrike returned -44.6% and -22.9% in November respectively.

Looking at the cybersecurity sector specifically there were some corrections over Q4 with investor enthusiasm waning for some names such as Cloudflare (down 40% from its peak). However, generally earnings were strong and, in many cases, exceeded analyst expectations. For example:

| Name | Latest earnings report summary | Drawdown from peak (as at 31 Dec 2021) |

| Zscaler | Beat estimated earnings by 17% reporting EPS of $0.14 vs estimates of $0.12 | -13% |

| Cloudflare | Beat estimated revenue by 4% reporting $172m in revenue during the quarter vs expectations of $165m. | -40% |

| CrowdStrike | Beat estimated earnings by 70% reporting EPS of $0.17 vs estimate of $0.10. Revenue up by $148m from the previous year. | -30% |

| KnowBe4 | Beat estimated FY21 revenue growth by 4% reporting $64.1m beating consensus of $61.6m. | -22% |

| Darktrace | Revenue growth of 41% YOY and a revenue CAGR of 52% from 2018 to 2021. | -57% |

Source: Bloomberg, 31 Dec 2021.

Overall, this appeared to be more of a broader macro theme with many investors taking profits in a risk off market after strong performance earlier in the year rather than a case of disappointing earnings results. Please find a summary below of the top 10 detractors to performance over Q4.

Q4 ETF Attribution

| Name | Average Weight (%) | Total Return (%) | Contribution to Return (%) |

| DARKTRACE PLC | 1.88 | -48.51 | -1.21 |

| HENNGE KK | 2.24 | -36.65 | -0.90 |

| CROWDSTRIKE HOLDINGS INC – A | 3.03 | -16.69 | -0.50 |

| VIRNETX HOLDING CORP | 1.24 | -33.67 | -0.45 |

| SECUREWORKS CORP – A | 1.22 | -19.67 | -0.30 |

| VARONIS SYSTEMS INC | 1.34 | -19.84 | -0.28 |

| SPLUNK INC | 1.39 | -20.03 | -0.27 |

| COGNYTE SOFTWARE LTD | 0.93 | -23.75 | -0.26 |

| SOLITON SYSTEMS KK | 0.94 | -21.38 | -0.25 |

| MITEK SYSTEMS INC | 2.56 | -4.05 | -0.18 |

Source: Bloomberg 30 Sep 2021 to 31 Dec 2021.

Outlook

We would remind investors this is a long term strategy with an innate bet on the size of the industry expanding at the intersection of digitization and security. We also believe current valuations still imply the sector has strong growth potential particularly given the strength of many of the underlying thematic drivers such as increasingly digitsed corporations and organizations (and people) and governments expanding digital security investments.

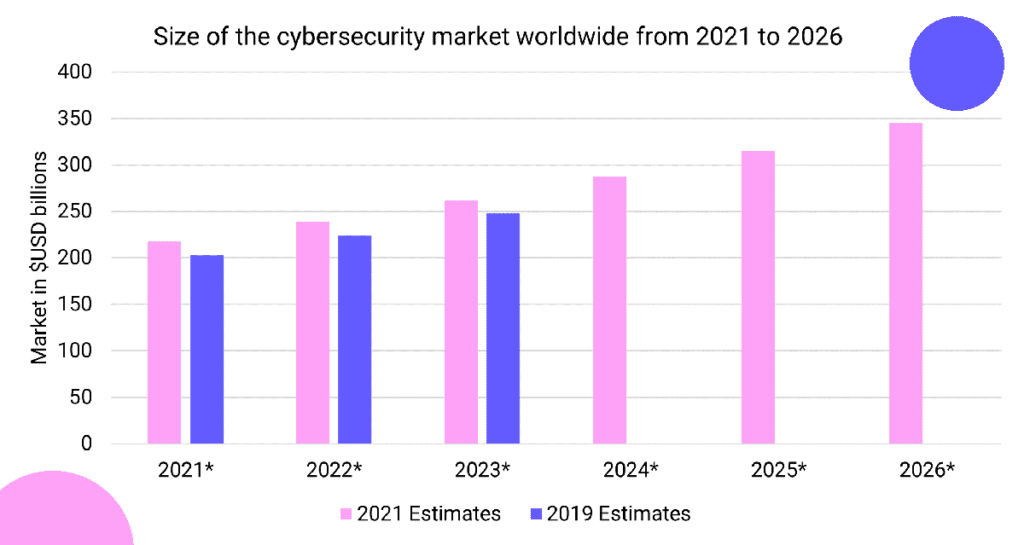

It’s worth highlighting some estimates from MarketsandMarkets and Statista. The chart below shows the estimated size of the future global cybersecurity market with the dark blue and light blue bars representing estimates made in 2021 and 2019, respectively. The latest estimates point to an expected 2021-2026 CAGR of 9.7% and we would admit that most charts showing global cyber security trends are upward sloping! What is more interesting is how these latest estimates differ from those made just two years ago. Clearly with the latest estimates showed side by side to those made just two years ago, where available, you can see these have been upwardly revised in 2021. This suggests the market has not only grown but has grown beyond expectations – causing expectations for future growth to be reconsidered – and if this trend continues moving forward then based on surprises this should translate as a positive for performance moving forward.

Related ETF

Subscribe to ARK Research & Insights