FEATURED ARTICLE

The number of significant climate change events has skyrocketed in 2022, as each passing week brings us new challenges from water scarcity to forest fires to intense, stifling heat waves. The investment media’s coverage of such events is also heating up, with many outlets weighing in on what to do to address these issues.

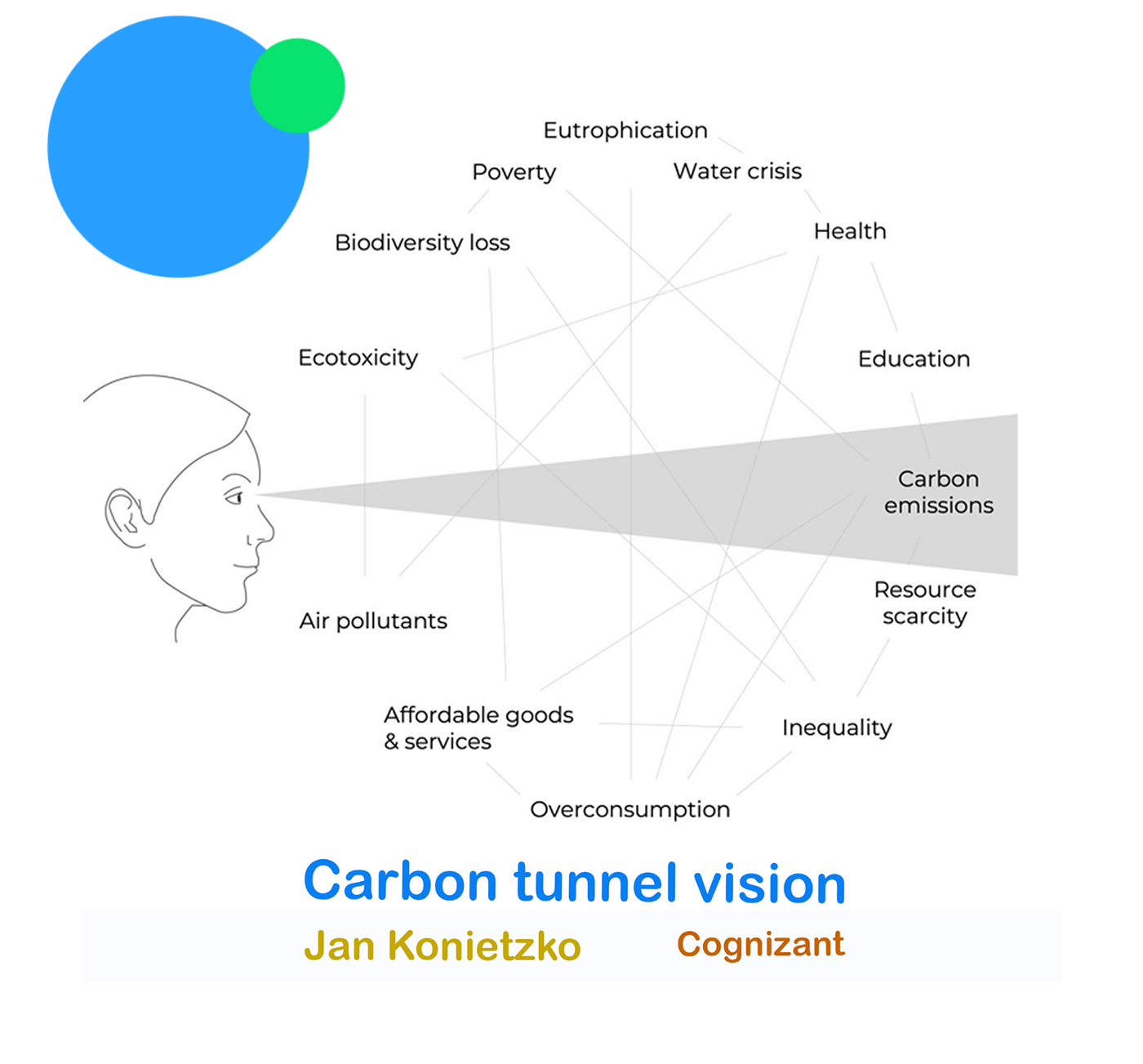

Take for instance The Economist’s summer series on ESG. The editors propose ignoring social and governance challenges to focus solely on “E”. But by “E”, they mean Emissions, not the Environment. Focusing solely on emissions, to us, is not the right prescription.

Goodhart’s Law is the notion that when a measure becomes a target, it ceases to be a good measure. Consider Volkswagen’s emissions scandal: when the US Environmental Agency set strict emissions targets, Volkswagen intentionally programmed its turbocharged diesel engines to activate their emissions controls only during laboratory testing. The vehicles’ greenhouse gas output thereby succeeded in meeting US technical standards during regulatory testing, however emitted up to 40 times more greenhouse gases in real-world driving! In other words, Volkswagen gamed the system; they made the agency’s measure their target.

Beyond this critique, it should be clear that reducing environmental concerns to one single measure – emissions – will not in any way ensure that Earth’s resources will be intact for future generations.

Measuring – and reducing – CO2 emissions cannot, on its own, fix regional and national water crises, slow biodiversity loss or restore soil fertility.

Fortunately, the EU Taxonomy for Sustainable Activities recognises this point and outlines six important objectives for environmentally sustainable business activities[1]:

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

Our “Environmental Impact Opportunities” Thematic Classification uses these six environmental objectives as a basis for identifying the full suite of business activities that have the potential to tackle the world’s most pressing climatic and environmental challenges.

The Thematic Classification was also the inspiration behind our work to develop the Rize Environmental Impact 100 UCITS ETF, which seeks to invest in companies involved in the above environmentally sustainable business activities.

In other words, by focusing on all six environmental objectives, we built a fund that side-stepped the common trap of “carbon tunnel vision”.

Climate Change and so much more

The fund is a nod to the reality that more and more business activities and investment in business activities is needed if we are to adapt to an ever-changing climate and environment.

Thankfully, in recent years, a groundswell of societal awareness has given rise to technological innovation that seeks to tackle the challenges. A greener future tomorrow means investing in the most promising companies today that can manifest their sustainable ideas into productive realities.

In the section below, we highlight two of these companies.

Great Lakes Dredging and Docking

One major preoccupation for investors today – beyond emissions – is the rise in sea levels and increasing damage to our coastlines due to more frequent, severe weather events. Indeed, 65% of the world’s megacities are within 100 kilometres and 50 meters elevation of the coast.[2] With sea levels rising, it’s never been more important to protect and improve coastlines.[3]

Great Lakes Dredging and Docking (“Great Lakes”) is the leading provider of dredging services in the United States specialising in projects that help improve and protect infrastructure and coastlines. Some of their projects include maintaining 130 miles of New Jersey Atlantic coastline of beaches, dunes and berms and several projects on the Louisiana coastline that protect and replenish eroding shorelines and marshes that provide a habitat for aquatic species and migratory birds.[4]

Kurita Water Industries

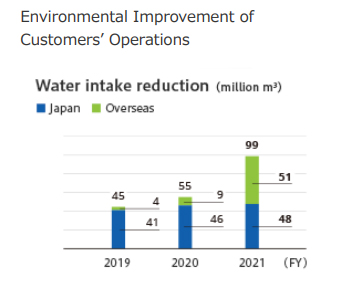

A second environmental preoccupation for investors today is water scarcity. Water is a finite resource with growing demand. As the global population increases, and resource-intensive economic development continues, many countries’ water resources and infrastructure are failing to meet rising demand for clean water. Currently, 2.3 billion people live in water-stressed countries and while developing countries have historically suffered more acute water shortages, water management is increasingly a challenge in developed nations too.[5]

Indeed, given recent droughts, this topic is increasingly top of mind for investors, policymakers and regulators alike.

Kurita Water Industries (“Kurita”) provides systems to recycle water, reduce waste, convert waste into fuel and provide equipment to improve the efficiency of boilers and cooling equipment.

Kurita is one of the world’s largest suppliers of water treatment equipment, chemistries and services.

Through its products and services, Kurita’s clients can reduce the feed water volume of their operations by optimising and managing water quality (principally in boiler systems) and recirculating water in cooling water systems, as well as recovery and reuse of wastewater. As Kurita’s revenue grows, more water is being saved.

Conclusion

There’s no doubt that meeting the world’s multiple environmental challenges will be a complex, multi-faceted task. Ensuring that we can meet our own needs without compromising the ability of future generations to meet theirs urgently requires tackling climate change and our most critical environmental challenges. That means reducing our dependence on fossil fuels, but it also means addressing other urgent natural resource challenges.

The Rize Environmental Impact 100 UCITS ETF was designed specifically with these dual objectives in mind. The fund provides investors with exposure to the 100 most innovative and impactful companies (such as Great Lakes and Kurita) that are tackling our most pressing climatic and environmental challenges. The fund also provides diversification across several environmental sub-themes which is both smart investing and optimal in achieving the desired real-world outcomes.

This Featured Article has been produced by Sustainable Market Strategies. Rize ETF Ltd make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability or suitability of the information contained in this article.

Related ETF

LIFE: Rize Environmental Impact 100 UCITS ETF

LUSA: Rize USA Environmental Impact UCITS ETF

References:

[1] Morningstar, “EU Taxonomy of Sustainable Activities”, 2022. Available at: https://www.morningstar.com/en-uk/lp/taxonomy-of-sustainable-activities

[2] Glasow, R. & Jickells, T. & Baklanov, Alexander & Carmichael, Gregory & Church, T. & Gallardo, Laura & Hughes, Claire & Kanakidou, M. & Liss, P. & Mee, Laurence & Raine, Robin & Ramachandran, Purvaja & Ramachandran, Ramesh & Sundseth, K. & Tsunogai, Urumu & Uematsu, Mitsuo & Zhu, Tianjie. Megacities in the Coastal Zone. Royal Swedish Academy of Science (2012).

[3] Kulp, S. A. & Strauss, B. H. New elevation data triple estimates of global vulnerability to sea-level rise and coastal flooding. Nat. Commun. 10, 4844 (2019).

[4] Great Lake Dredge & Dock. Coastal Protection and Restoration http://gldd-projects

[5] United Nations. UN Water Summary Progress Update 2021 Water Scarcity | UN-Water (unwater.org)

Subscribe to ARK Research & Insights